Edge Computing M&A: Data centers, AI top edge investment hotspots

The growth of IoT applications has propelled the need for low latency networks with better security and faster data processing capabilities. Thanks to edge computing, organizations can establish decentralized architectures required for meeting these goals. As more tech companies plan to become edge-ready, investments in edge infrastructure are picking up pace.

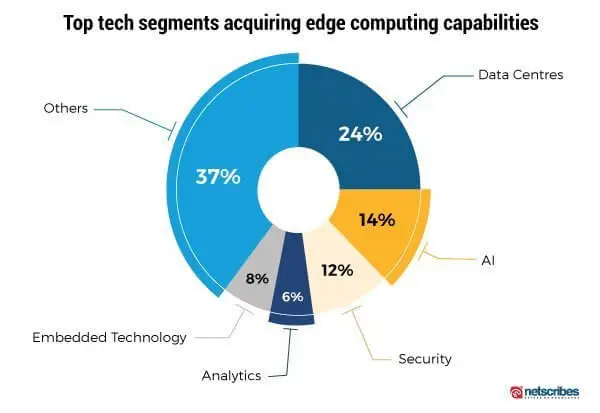

Netscribes research shows that edge-computing-driven M&A more than doubled in 2018 compared to the previous year. Here’s a look at the top areas of edge investment over the past five years.

Data centers

The data center industry is the top acquirer of edge-ready solutions. Our research shows that 24% of edge computing M&A is focused on developing micro data centers that cater to several geographical areas. Edge micro data centers are rapidly gaining traction owing to their modular sizes, cost-effective design, and ability to handle a variety of workloads within an IoT network.

Compass Datacenters, Scalematrix, and EdgeConnex are some major acquiring companies focused on edge micro data centers.

Artificial Intelligence

Edge-ready AI or Edge AI has several advantages over traditional cloud-based computing, such as reduced round-trip latency, unified solutions, and better data security and privacy. This explains the growing interest in edge-ready AI platforms, especially between the 2018 to 2019 period.

Our research shows that Edge AI constitutes 13.5% of total edge-related M&As, led mainly by semiconductor, software, and IoT companies. Some of the key applications of Edge AI include on-device deep learning solutions, predictive analytics, computer vision features, among others.

Silk Labs’ acquisition by Apple is a prime example of companies trying to put AI/machine learning at the edge. The startup’s on-device AI platform carries out object detection, audio detection, and facial recognition more securely and efficiently than cloud-based AI.

Other notable deals include Altair’s acquisition of Candi Controls, and VMware’s purchase of Uhana solutions.

Security

Distributed computing environments, such as online services, telephone, and cellular networks, are highly vulnerable to cyber-attacks. As IoT installations continue to grow, securing data at the edge, such as on a user’s device or a micro data center, will be crucial for enhanced privacy and security in connected environments. A number of cybersecurity firms, therefore are acquiring edge capabilities, with a focus on endpoint detection, certificate authority, security frameworks, and authentication techniques.

In 2017, HPE acquired Niara, while Juniper Networks acquired Cyphort. These security analytics firms utilize machine learning and behavioral analytics techniques to automate threat detection and build intelligent edge platforms with complete visibility.

Analytics

Real-time analytics in IoT installations requires that data is analyzed closer to where it’s captured – at the edge. So a number of IoT solution providers are acquiring Edge Analytics capabilities to augment their portfolios. These include capabilities such as real-time visual analytics, compression, and indexing, self-service and streaming analytics solutions.

In 2016, IoT managed service provider, Greenwave Systems, acquired real-time visual edge analytics software company, Predixion. More recently, Guavus, an AI-based analytics firm, acquired the real-time streaming analytics company, SQLstream.

Embedded Software

The embedded systems industry is shifting towards embedded software that cater to edge applications, especially for Industry 4.0. Accenture and Smart Global Holdings lead the acquisitions in the embedded technology space for edge computing and IoT applications.

Accenture acquired Pillar Technologies, an embedded software company that brings complementary software skillsets essential at the testing stage. It has also acquired Mindtribe, a hardware engineering company with expertise in embedded software development.

Smart Global Holdings acquired two companies, Artesyn Embedded Computing, and Inforce Computing to enter the embedded computing market. The acquired capabilities are being utilized for developing edge system-on-module and other embedded computing platforms for IoT applications, expanding Smart Global’s target markets and enabling cross-selling of its existing products to new customers.

In addition to the segments listed above, the year 2018 witnessed M&A activities across MEC, SD-WAN, mesh IoT, blockchain, edge modules, and IoT managed services for edge computing applications. Companies across sectors are evaluating the impact of edge computation and are accelerating acquisition strategies in the domain to unlock new IoT business opportunities. The increased momentum of M&As attests to the growing impetus of edge computing on technology strategies.

Netscribes helps companies keep track of rapid technological changes and assess their potential impact on businesses through a synthesis of market and technical data. For in-depth research and analysis on the edge computing industry and how your market is adapting to its evolution, contact info@dev.netscribes.com.

To understand the edge computing strategies undertaken by global companies, get our report – Edge Computing M&A Analysis.