The impact of COVID-19 on consumer buying patterns

A little over ten weeks into the novel coronavirus (COVID-19) and consumers across the globe are trying to stave off uncertainties by stockpiling. The pandemic has caused major spurts for industries like delivery and subscription services while fashion and other luxury markets continue to slide. Local manufacturing will soon be highly sought-after, giving small and midsized businesses their chance to shine.

From shelf-stable foods to hand sanitizers and everything in between, there’s little separating consumers across geographies in their consumption patterns. To help retailers, especially in the grocery, CPG, and health & hygiene space stay proactive, here’s a round-up of the top three consumer trends we observed globally:

Stay at home culture boosts e-commerce

The flu-like nature of COVID -19 is the reason behind the thinning mall and retail store footfalls. In fact, a recent survey revealed that over a quarter of US respondents are avoiding public places and 74.6% have decided to limit their store visits. On the other hand, the ones to benefit from this windfall are e-commerce platforms. Brands with an online presence should seek to stack their online inventory if they want to make good, in any way, of the lost in-store opportunity.

Also, such unpredictable circumstances demand retailers to take a closer look at their predictive models in order to stay well-stocked. Yet another interesting development observed: Local retailers in COVID-19 unaffected areas are experiencing unprecedented demands, compelling them to order inventory from their online counterparts.

Grocery and food delivery services are the ones capturing the true e-commerce momentum in this crisis. Apparel renting platforms and consumer electronics firms, among other China-based manufacturing industries, are facing a considerable hit given the fear germ-transmission attached to these products.

Depleting market for fresh and exotic foods, and a spike in shelf-stable products

The fresh foods market may soon see lesser takers, particularly exotic food items that may have traveled long distances, exchanged many hands with little or no way to prove their hygiene quotient. Consumers are instead increasingly opting for canned foods, or products with a longer shelf life that is risk-free, to add to their “pandemic pantry” pile.

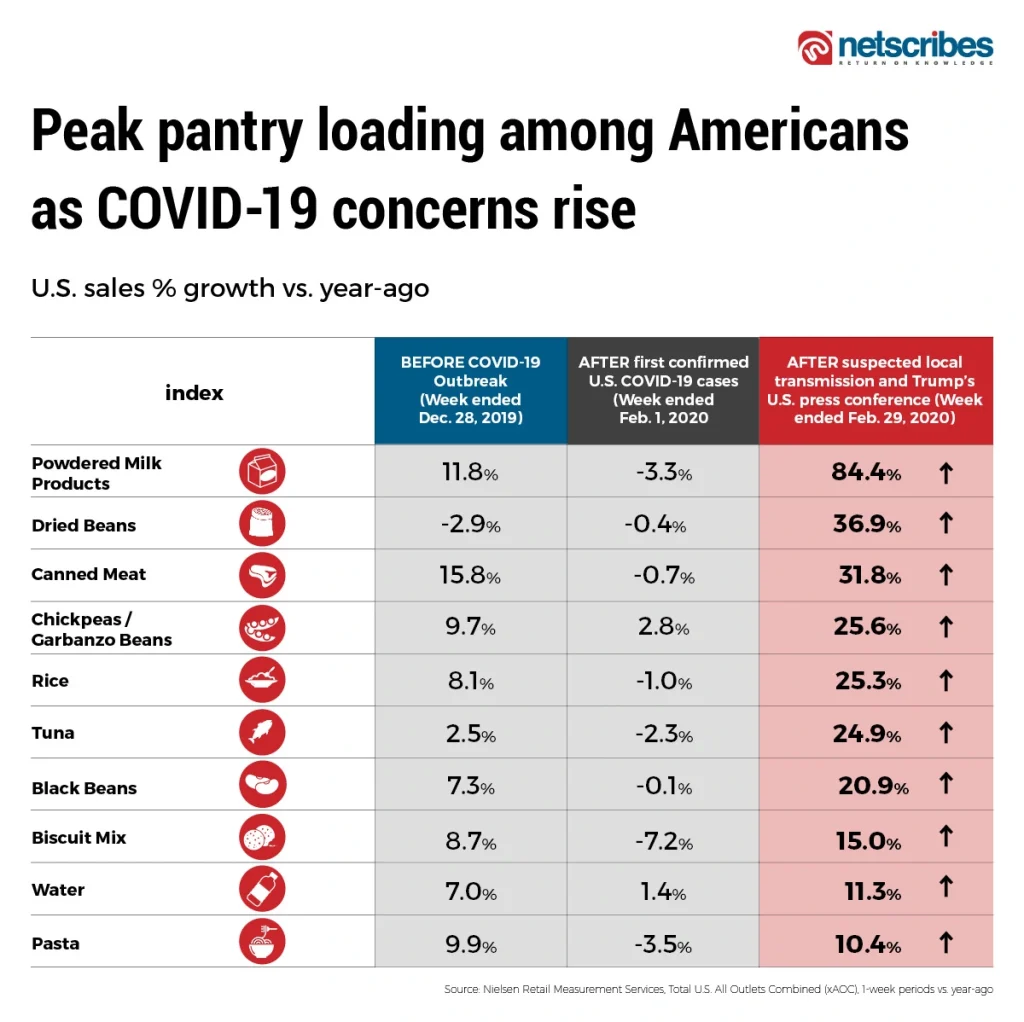

A recent Nielsen study reveals that in the US, pantry preparations during the last week of February 2020 resulted in record sales not just in dried beans (+37%), canned meat (+32%) and rice (+25%) but also antiseptics, hand sanitizers, over-the-counter cold remedies among other health essentials. Below is a snapshot.

Also, retailers like Target and Walmart have been sourcing 30% and 15% of their inventory from China respectively. In view of COVID-19 and consumer buying patterns, the two magnates are tweaking their assortments and product promotions. Other players would be well served to follow their example in order to retain loyalty.

Quality and trust take top priority

Fluid facts about this global health emergency are compelling consumers to look for veritable information to get a grip on how they can truly stay safe. In such pressing times, when it comes to choosing between value and quality, the latter wins. Amidst COVID-19 consumer buying behaviors are consciously moving away from a cost-saving nature. Instead, if consumers can be convinced of the hygiene and untampered production process, they are willing to shell that extra buck.

Brands and retailers that can clearly communicate the safety standards undertaken to ensure their products are risk-free and of the highest quality will gain the consumer’s trust. Food, baby care, healthcare, and hygiene items particularly must provide additional information about its manufacturing and packaging procedures highlighting their safety measures. Here’s a look at the most sought-after attributes consumers are willing to pay more for, according to a Nielsen study.

While retailers are grappling with this panic buying spree, a continuous track of the reigning consumer sentiment and market trajectory will help plan better contingency strategies. Netscribes helps leading retailers and businesses globally with robust market research and timely insights to formulate well-rounded, data-driven business decisions. To know how we can help you, contact info@dev.netscribes.com.