Amazon’s Project Kuiper: What it means for the space industry

The growth of IoT depends on uninterrupted, high-speed and global internet coverage. But with a large portion of the world still unconnected and cellular networks being limited, organizations are betting on satellites to actualize next-generation IoT applications. Satellite mega-constellations in the low Earth orbit (LEO) are being planned to offer low-latency, high-speed broadband connectivity with truly global coverage. The latest company that plans to build these next-generation satellites is Amazon, with its ambitious “Kuiper” project.

What is Project Kuiper?

With a focus on delivering advanced, 24×7 connectivity globally, Project Kuiper involves the launch of a mega constellation of 3,236 satellites into LEO. These satellites will be grouped into three large sets and will be deployed at three different elevation points – 784 satellites will orbit at an altitude of 590km, 1,296 satellites at 610km, and 1,156 satellites at 630km.

The data coverage resulting from Project Kuiper will stretch between 56 degrees north and 56 degrees south latitudes. This covers nearly 95% of the global population and will gradually expand to other regions as more satellites are launched.

Project Kuiper’s satellites will work with Amazon’s previously-announced AWS Ground Station unit – a network of 12 satellite facilities around the world – for transmitting data to and from satellites in orbit.

Amazon’s wholly-owned subsidiary, Kuiper Systems, recently joined the Satellite Industry Association (SIA) and is seeking approval from the Federal Communications Commission (FCC) for its space project.

Why LEO satellites?

So why did Amazon choose to launch its satellites in the low Earth orbit? IoT applications require low cost, low power, and small terminals that can transfer signals with minimal loss.

Being closer to the Earth’s surface, LEO satellites reduce communication path loss and use low terminal power required for low-latency, high-speed broadband connectivity, making them ideal for IoT applications.

At present, terrestrial services (cellular, Wi-Fi, Bluetooth, LoRA or Sigfox) are driving IoT deployments. Cellular networks are especially suitable for applications where real-time connection and speed is important. But, with only 10% of the world covered by cellular networks, organizations need the wider coverage offered by satellites. This will be crucial to extending IoT services to remote areas where cellular connectivity is limited or non-existent.

However, satellites in LEO are constantly moving which can create connectivity issues. To ensure continuous coverage, thousands of satellites need to work in a synchronized constellation so that they are always in range, even when devices are in motion.

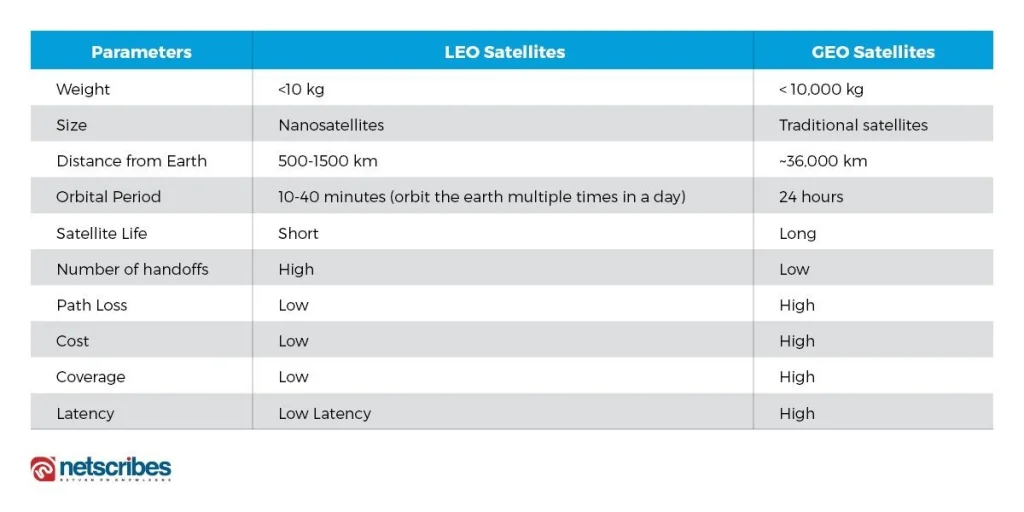

LEO vs GEO satellites compared

Here’s how LEO satellites differ from conventional satellites in the geostationary earth orbit (GEO).

With Project Kuiper, Amazon will be competing against the likes of SpaceX and OneWeb who are planning similar large-scale LEO constellations with the goal of making global internet a reality.

In February 2019, OneWeb launched six of its planned 1,680 satellites into LEO and plans to provide global coverage by 2021.

SpaceX’s Starlink project consists of a mega constellation of 12,000 satellites that will be launched into LEO. Of these, 60 were launched successfully in May 2019.

AWS Ground Station: Amazon’s trump card?

Satellites require ground stations to operate. Ground stations provide real-time communication with satellites, and in some cases, serve as control centers for the satellite network.

With AWS Ground Station, Amazon has set the stage for space companies to develop LEO constellations without worrying about the economic bottlenecks of the ground infrastructure. At the same, it poses significant competition to space startups like Fleet Space, KLEO, Astrocast and others that are developing or planning to invest in proprietary ground station services.

Additionally, startups like Infostellar and RBC Signals who offer ground station aggregation and interoperability services are also likely to compete with Amazon, even though their business models are fairly different. AWS Ground Station also gives Amazon a unique edge over SpaceX, OneWeb and Telesat that do not have any ground station infrastructure yet.

What it means for the space industry

Satellite communications, along with the entire space industry’s value chain, is transforming in order to meet the rising demand for IoT services and associated bandwidth requirements. It’s an exciting time in the space industry with innovative players building advanced satellite solutions and connectivity options.

The transformation is evident with rapid changes in satellite size, cost, function, and exploration of new orbits. Investment and funding in space research is shifting from public to private organizations, allowing private companies to enter the space industry in larger numbers. This revolutionary step is expected to result in incremental developments, with a focus on disruptive technologies and commercial viability.

For detailed research and analysis on the trends in satellite communications for IoT networks, contact info@dev.netscribes.com.