Benchmarking your digital-first strategies against market leaders to maintain your competitive edge

Much of the business forum conversations in 2020 were around the impelling need for digital-transformation. And Covid-19 has fast-tracked this mind-set across all business models and expedited the digital initiatives by many years.

Brands that are already digital-first have a sustainable competitive advantage over those still cashing the digital dream. However, with the explosive growth of automation tools available to support transformations, the laggards will soon catch up. This means more competition, rapid innovation, changing customer needs, and cut-throat marketing strategies will take the rise of information, tech, and customer expectations to new heights.

So how do digital-first brands future-proof their leadership and stay relevant beyond this era?

The future of digital-first platforms will especially depend on how they seize and monetize their disruptive potential. And since these brands operate with unconventional and progressive business models, the path to success relies heavily on their ability to anticipate and act on trends faster than their peers. This article will evaluate the top consumer-first strategies by the leading digital-first brands in current times. The examples will provide a starting point for creating a competitive roadmap to achieve the digital-first dream in 2021 and beyond. Let’s look at some of these initiatives and how the industry bigwigs have leveraged them.

Initiative #1: Re-Imagining Preferences of New-Age Digital Buyers

Case in Point: Netflix’s Consumer Science Technique

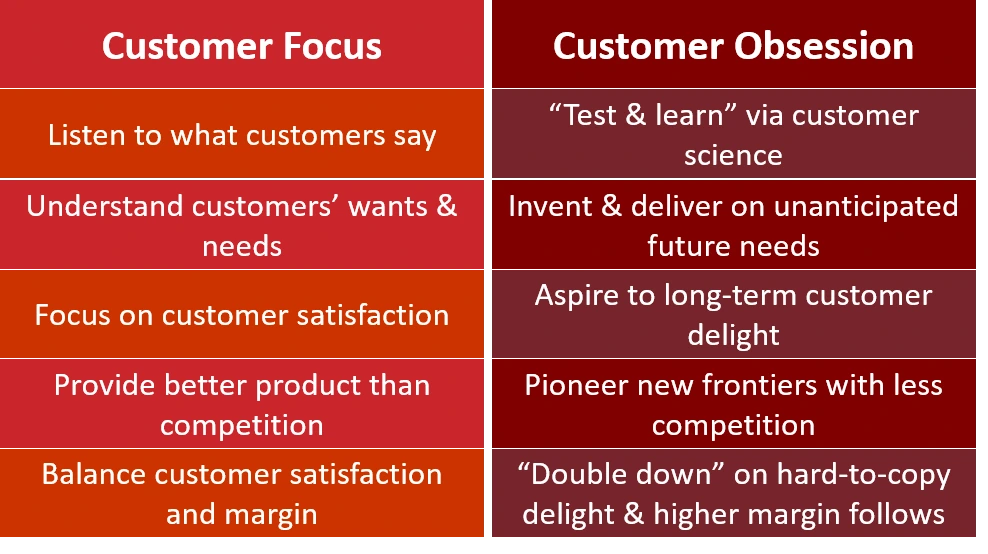

Netflix, as a brand, is committed to delighting customers by keeping a pulse of evolving viewer preferences. Gibson Biddle, former VP/CPO at Netflix, once said that Netflix is obsessed with its customers and has been experimenting with user data for a long time. They have been analyzing both quantitative and qualitative customer data to A/B test ideas since 2005 when they had merely 5 million subscribers. Fast-forward to today, they have 195 million subscribers and continue to re-imagine consumer preferences by applying consumer science techniques. Here’s how they sustain their disruptive potential by taking a completely alternate route to understand and deliver CX.

Netflix’s data-driven approach began way back in 2005 and included customer-centric metrics like unexplained customer behavior changes in addition to the traditional ones around retention, revenue, and cost. This led them to identify trends like:

- When Netflix was a movie rental service, they observed that monthly subscription cancel rates in the US soared in summer days as most people spent time outside. However, when they improved the disc delivery speed from three days to overnight, it lowered the cancel rates by nearly 2%. Thus, they concluded that “Increasing the rate of DVD shipment speed aids retention.”

- Qualitative research enabled Netflix to uncover critical nuance around language, visuals, and positioning. Focus groups helped them effectively understand the voice of the customer (VOC) in early digital delivery days. E.g. using phrases like “Watch Instantly” instead of “streaming”, which was not broadly understood at that time.

- CX surveys across all touchpoints were yet another strong science they relied on to gauge critical attributes like NPS, DVD delivery speed and streaming quality.

- Finally, Netflix engages itself extensively in A/B testing of ideas to form better CX and be future-ready.

Initiative #2: Rapid Innovation for matching evolving CX demands

Case in Point: How Amazon Fresh is leveraging scientific innovation to meet increased consumer demand

Amazon Fresh has a selection of tens of thousands of grocery products, everyday essentials, gifts and more. Additionally, they have introduced one and two-hour delivery, smart shopping Amazon Dash cart, order ahead features on the Amazon App and Alexa interactivity throughout the stores. They are constantly innovating and improving on the CX whether its offline or online. So, how are they doing it at such a scale?

Amazon Fresh is leveraging decades of Amazon operational experience and machine learning to enhance the grocery shopping experience by making it faster and more convenient, says Wei Gao, Amazon VP of grocery, product, and supply chain.

Scientists at Amazon Fresh leverage ML to solve some of these customer-centric challenges to meet the ever-increasing consumer demands at scale:

- Across the organization, ML and data science-enabled forecasting models assists analysts predict product demand. This allows their retail businesses to decide their inventory in the most optimized manner.

- To maintain high and relevant in-stock selection, the forecasting teams at Amazon developed multiple time-series models to enable the vendor-selection system to make purchasing decisions autonomously. This makes it possible for Amazon Fresh to continually provide customers with the best quality products at the lowest possible price.

- Their statistical models also empower them to decide and align vendor to product sourcing routes considering taking factors like quality, shipping times, and optimal price.

- Another area where data scientists are adding immense value is product selection. They use data attributes like product demand, consumption patterns, substitute products, and more for laying the best product assortments.

These forecasting models created by Amazon helped improve inventory availability by 15% during COVID-19 times.

Initiative #3: Persistently tracking the digital competitive landscape

Case in Point: Shopify’s sustained success in the face of e-com giants

Competition in the digital-first battleground has evolved beyond the traditional value propositions of cost and service. Digital-first brands compete on the grounds of disruptiveness, innovation quotient and unique business models, still servicing the same consumer segments of traditional industries. To thrive in such conditions, businesses will need to think outside the box while tracking their competition.

Shopify is an e-commerce platform that provides users and businesses with the ability to create full-scale online stores using its site creation, hosting, and payment platforms. Currently, Shopify has over a million merchants across 175 countries. Shopify competes with various businesses, from freemium to large, comprehensive and complex eCommerce platforms. How do they reign in such a diverse marketplace? Here are some of the competitive strategies that enabled them to build a sustained success story:

- Shopify fulfillment network is a product fulfillment engine that assists merchants on the Shopify platform utilize multiple software elements to store, pack, and ship products at very competitive costs.

- They offer discounted shipping rates when fulfilling through Shopify or Shopify partners. This puts Shopify in apparent competition with Amazon, but it lets them stay competitive and attract users to its platform.

- Shopify API and App Store follow the Salesforce model and creates a developer-centric ecosystem. Like in Salesforce AppExchange, their ecosystem lets merchant developers build customer-centric web stores on the back of Shopify, and with 820,000 merchants, 4,100 apps, 350,000 paid themes, they are the go-to platform for eCommerce.

Initiative #4: Service delivery innovation leveraging new-tech

Case in Point: Uber’s shift from ride-hailing services to essential delivery solutions during Covid-19.

Uber says that they experiment a lot for service delivery innovations and Covid-19 expedited the process like never before. “It’s embedded within our culture to bet on ideas we think are solving essential needs that aren’t yet met for the consumers we serve,” said Meg Donovan, Global Director of brand and product marketing at Uber. Here’s how they introduced innovative solutions leveraging tech to match the relevance of time. These services were incongruous with their traditional business model but still worked well.

- Uber started Uber Connect, a same-day, on-demand, no-contact delivery service that was designed and introduced very quickly during the start of the pandemic. The product development and the marketing team relied on the customer experience research and the market research team’s inputs that prompted Uber to launch the service. As of date, Uber Connect is now live across 200 cities worldwide and has delivered millions of products.

- Another aspect of Uber Connect worth understanding is that since the service was launched globally, services across each location had to be adjusted to follow the local guidelines and appropriate market needs. E.g. supplying food and rides to NHS workers was the UK’s focus, whereas, in the USA, Uber partnered with Feeding America to serve meals to the most vulnerable population, and in South Africa, they focused on delivering healthcare packages.

The bottom line: Expecting outstanding digital CX has become the default for consumers. Now it is about how businesses improve their ability to deliver it.

To adopt and successfully execute any of the above strategies, your business and brand will have to commit to leveraging the digital-first approach for diligently providing consumers with pragmatic solutions that are exclusive, personalized, and deeply thoughtful. You will need to exceed customer expectations across touchpoints in the consumer journey. This will require a healthy blend of technology, data and analytics on a progressive level. Partnering with companies like Netscribes that provide integrated information and insights solutions to digital-first businesses like yours would open up the complete picture of what your consumers expect, recognize growth opportunities, and identify competitive threats for staying future-ready. To learn how Netscribes can help you meet your marketing goals and adapt to market and technology changes, contact us.