Ecommerce growth and scalability for long-term success

Highlights:

- Predictive analytics helps forecast demand and reduce churn.

- Modular tech stacks scale faster under pressure.

- Top brands like Walmart and Gymshark show strong ROI from flexible systems.

- Omnichannel consistency boosts loyalty and delivery speed.

- Growth metrics matter—conversion, margin, and time-to-market lead the way.

Rapid ecommerce growth is exciting—but unless it is matched with systems that can absorb demand spikes, predict market shifts, and support expansion into new channels, that growth can quickly stall. Record online demand, volatile supply chains, and rising customer expectations have transformed scale from a nice-to-have into a non-negotiable. Global B2C sales are projected to exceed USD 5.5 trillion by 2027—a market that will reward retailers who translate traffic spikes into sustainable ecommerce growth rather than temporary surges. Achieving that level of resilience demands two tightly linked capabilities:

- Predictive analytics that turn data into foresight, driving proactive decisions.

- Modular, API-first e commerce solutions that flex as volumes, channels, and expectations expand.

Brands that combine these disciplines consistently outperform peers on conversion, margin, and customer lifetime value.

From traffic to value: why scale sits on the C-suite agenda

Peak-season site crashes, out-of-stock frustrations, and fragmented omnichannel journeys erode trust and lifetime spend. 40% of mid-market retailers still operate monolithic platforms that buckle under Black Friday or Singles’ Day pressure. The cost of failure is steep: every second of page-load delay can depress conversions by up to 7%. Sustainable ecommerce growth therefore hinges on architecting capacity headroom, supply-chain clarity, and data-driven agility.

Predictive analytics: moving from hindsight to foresight

Forward-looking retailers are shifting investment from rear-view dashboards to predictive analytics engines that forecast, prescribe, and continuously learn:

- Demand sensing and inventory optimization

ASOS applied AI-driven forecasting to a catalogue exceeding 85,000 SKUs, cutting stock-outs by 15% while reducing surplus inventory—a critical enabler of profitable ecommerce growth. - Targeted lifecycle marketing

Macy’s built more than 20 predictive models in weeks, personalizing email cadence and content to lift online sales by 8-12%. - Dynamic pricing

Fashion retailers using elasticity models have lowered seasonal markdown costs by 40% while protecting margin. - Churn anticipation

Subscription players flag high-risk cohorts and intervene with tailored offers, reducing attrition by up to 18%.

Embedding these insights into daily decision loops converts raw data into repeatable ecommerce excellence.

Case Study #1 – fashion-accessory leader

A global accessories brand doubled its online assortment in two years yet routinely missed demand spikes. A cloud-native predictive analytics platform delivered:

- +20 % forecast accuracy

- –15 % stock-outs

- +12 % incremental digital revenue in six months

The shift from reactive buying to predictive replenishment positioned the firm for scalable ecommerce growth while slashing working-capital drag.

Scalable architecture: foundations that flex rather than fracture

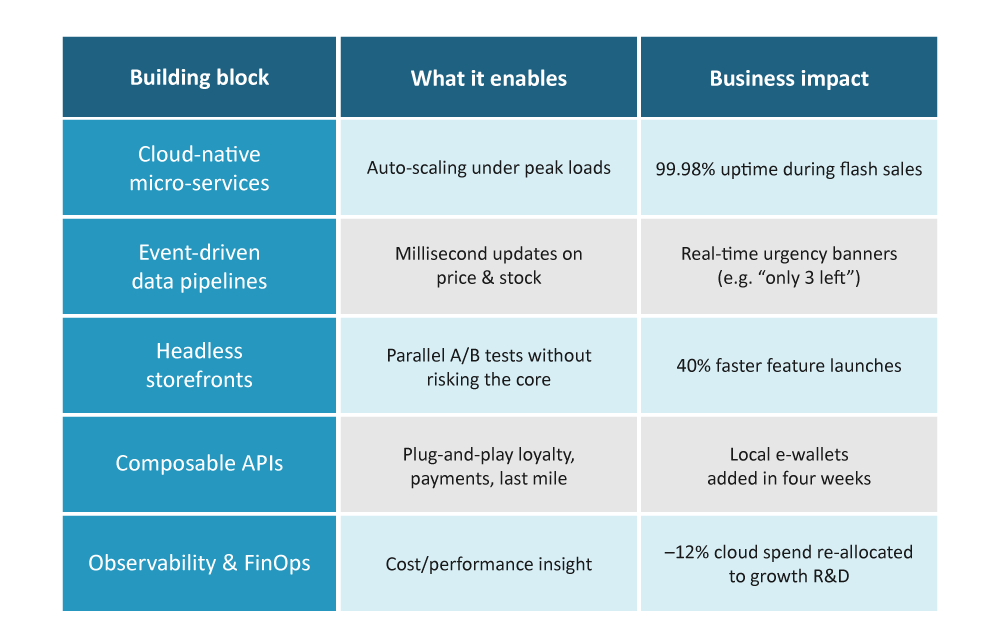

High-velocity retail needs more than clever math; it needs infrastructure built to absorb change:

Together, these e commerce solutions provide the elastic backbone required for consistent ecommerce growth.

Case Study #2 – Gymshark’s headless reboot

After a high-profile site crash, Gymshark adopted a MACH-aligned headless stack, achieving:

- $20 million incremental annual revenue

- Search conversion jump from 6.2-10%

- 4× revenue growth from search users in 12 months

This illustrates how architecture and insight jointly power ecommerce excellence.

Omnichannel orchestration: delivering one brand, many doors

Modern customers glide between mobile, marketplace, and store—expecting continuity of prices, inventory, and rewards. Winning retailers orchestrate:

- Unified identity—so wish lists, loyalty points, and promotions follow the shopper across touchpoints.

- Micro-fulfillment networks—combining regional hubs with store-back rooms for two-hour delivery.

- Shared promotions engines—triggering email, push, and POS offers from a single rule set.

Big-box leaders such as Walmart and Target employ AI to predict regional demand, repositioning stock before shelves empty—a practice that doubled Inventory Ledger coverage at Target and drives bullet-proof availability. Such capabilities safeguard service levels even as volumes climb, underpinning durable ecommerce growth.

Case Study #3 – AI-powered inventory at scale

Walmart’s rollout of AI-driven distribution hubs—each able to double throughput with half the labor—illustrates the payoff of combining robotics with predictive analytics. The chain’s newest refrigerated warehouses anticipate demand for perishables, boosting freshness and slashing waste. These moves reduce cost-to-serve while elevating customer experience—key levers of ecommerce excellence.

Financial metrics the board actually cares about

Well-executed scale programs consistently deliver:

- Conversion rate +15–30 % through faster pages and hyper-relevant offers

- Average order value +10–20 % from intelligent cross-sell and bundling

- Gross margin +3–5 % via markdown optimization and lower spoilage

- Fulfillment cost –8–12 % from smarter routing and fewer returns

- Time-to-market –40 % thanks to composable, reusable e commerce solutions

- Net promoter score +15–25 pts from seamless, personalized journeys

These metrics evidence strategic—not superficial—ecommerce growth.

Read more: Transforming ecommerce strategies with predictive analytics

Overcoming the five classic barriers

1. Technical debt – Use strangler-fig patterns to wrap APIs around legacy cores, avoiding “big-bang” migration risk.

2. Data silos – Stream orders, product data, and clickstreams into a unified Lakehouse for enterprise-wide predictive analytics.

3. Capability gaps – Stand-up cross-functional pods blending merchandising, engineering, data science, and CX.

4. Privacy & ethics – Embed consent orchestration, bias audits, and explainable models to maintain trust.

5. Change fatigue – Pilot lighthouse projects (e.g., churn prediction) that prove ROI in 90 days, funding broader rollout.

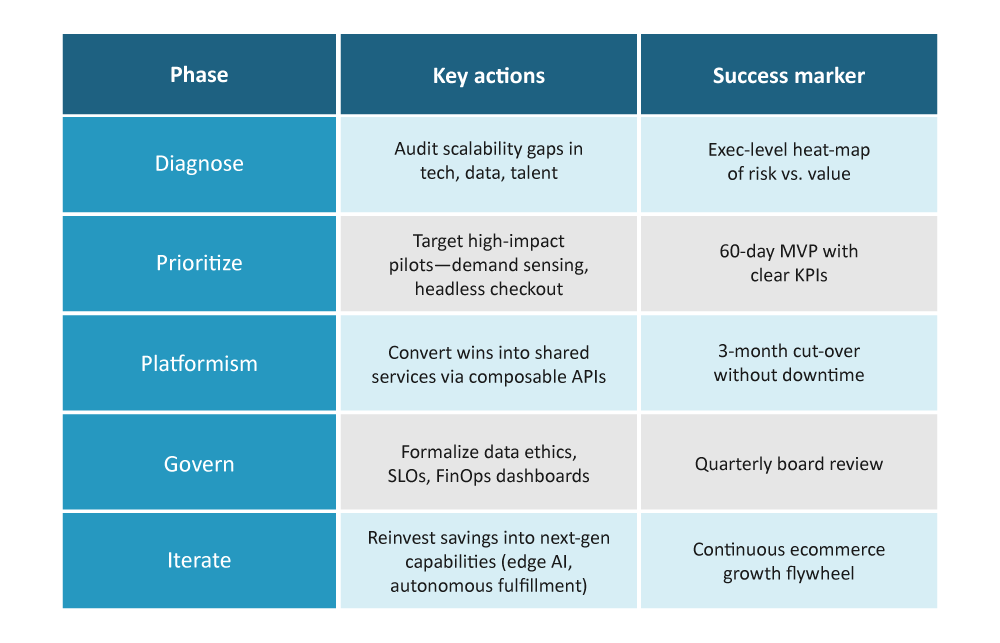

Roadmap to enterprise-wide Ecommerce excellence

Conclusion

Flashy traffic spikes may win headlines, but lasting ecommerce growth belongs to brands that couple foresight with flexible foundations. By embedding predictive analytics across demand, pricing, and engagement—and by deploying modular e commerce solutions that scale without drama—retailers create a virtuous cycle of operational efficiency and customer delight. Case studies from ASOS, Gymshark, Walmart, and Macy’s demonstrate that when insight, architecture, and governance align, growth is not only rapid—it is resilient, margin-accretive, and future-proof.

The mandate is clear: audit readiness, light pilot projects that prove value fast, then capitalize on that success. In doing so, organizations will not merely keep pace—they will set the standard for ecommerce excellence in 2025 and beyond. Explore our end-to-end ecommerce solutions now.