Future-proofing growth of resale ecommerce platform market

Highlights:

- Wallet-conscious shoppers and sustainability are fueling resale growth.

- ThredUp, Poshmark, and Vinted showcase scalable resale strategies.

- AI tools combat fraud, simplify listings, and optimize dynamic pricing.

- Subscription perks and SaaS dashboards diversify ecommerce revenue.

- Trust features like grading, seller badges, and guarantees drive conversions.

- ESG metrics and localization strategies future-proof global platform growth.

The global appetite for second-hand goods has shifted from late-night auction sites to slick mobile apps where preloved fashion, electronics, and collectibles trade hands in seconds. According to ThredUp’s 2025 Resale Report, online resale grew 23% in 2024 and is projected to double again by 2029, reaching $40 billion in the United States alone. That momentum is mirrored worldwide, with analysts estimating the entire second-hand apparel segment could top $367 billion within the decade. For founders and brand leaders, the big question is how to future-proof growth in an increasingly crowded ecommerce platform market—while still meeting investor expectations on revenue, retention, and sustainability.

This blog lays out the drivers, challenges, and technology levers you’ll need to convert today’s boom into tomorrow’s durable advantage. We’ll reference proven case studies—Poshmark, ThredUp, and Vinted—to show how savvy operators can turn circularity into commercial success in the wider ecommerce platform market.

1. Market drivers: Value, values, and volatility

Three structural forces are propelling resale:

- Wallet pressure – Persistent inflation has shoppers trading down or hunting deals. Nearly 60% of U.S. consumers say rising apparel prices will push them toward second-hand options.

- Sustainability – Gen Z and Millennials reward brands that extend product life cycles, making resale a credibility boost in the broader ecommerce market.

- Brand participation – More than 160 global labels now run take-back or “pre-loved” programs, pushing fresh inventory into the circular supply chain.

Collectively, these factors forge a growth path that traditional first-party retail can’t easily replicate—creating a distinct lane in the ecommerce platform market.

2. Case study – ThredUp’s resale-as-a-service

ThredUp does more than list items; it powers branded recommerce for retailers like Gap and Madewell. By offering logistics, authentication, and white-label storefront modules, it monetizes surplus gear while cementing retailer loyalty. With online revenue growing faster than store sales, ThredUp illustrates how an ecommerce platform can diversify into enterprise services—derisking reliance on consumer traffic alone.

Key Takeaway: Build APIs and fulfillment rails once, then rent them to partners—an asset-light path to share of the expanding ecommerce platform market.

3. Case study – Poshmark’s community flywheel

Poshmark leans on social mechanics: likes, shares, and “closet clear-outs” that mimic the feel of an Instagram feed. The platform hosts 80 million live listings and clocked a 300% jump in repeat buyers during the pandemic years, proving engagement over pure price competition. Every comment or share boosts item visibility, which in turn boosts seller success—fuel for compounding retention in an ecommerce platform landscape crowded with look-alikes.

Key Takeaway: Layer social proof and gamification into listing workflows to cultivate peer-to-peer virality, not just transactional velocity.

4. Case study – Vinted’s pan-European expansion

Lithuania-born Vinted now operates across 20+ countries and claims a €8 billion annual gross merchandise volume, propelled by cross-border shipping integrations. Low seller fees and in-app shipping labels remove friction, making Vinted the de-facto resale destination for EU shoppers. Its growth underscores the value of seamless logistics when scaling a multi-market ecommerce platform market proposition.

Key Takeaway: International success hinges on local payment options, tax compliance, and trusted delivery partnerships—elements best architected early, not after traction.

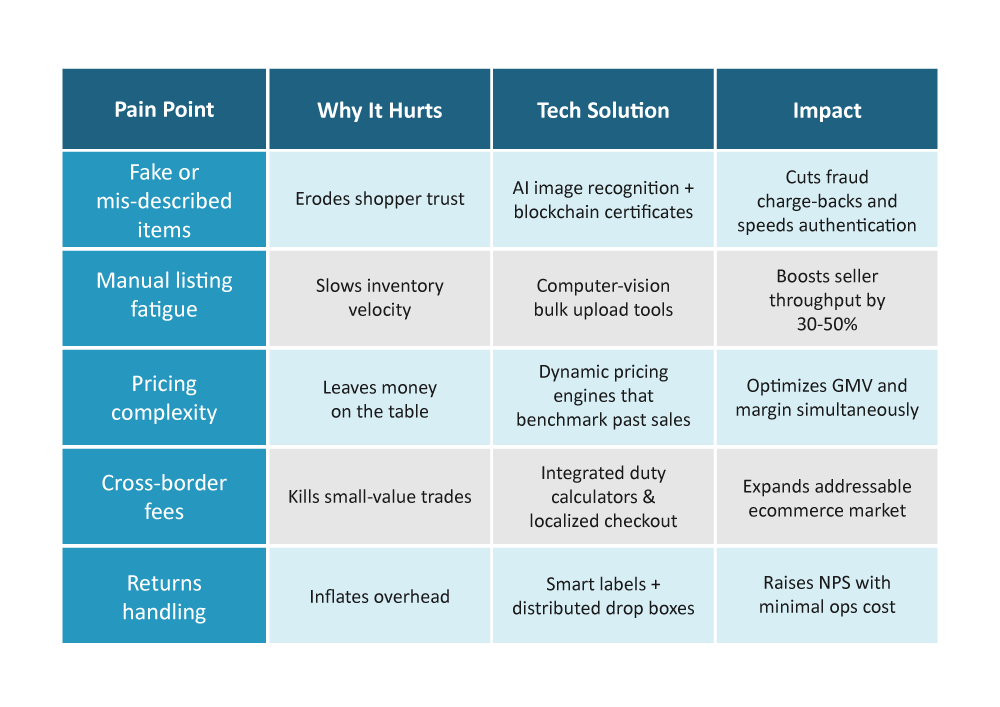

5. Pain points and technology fixes

Deploying these tools not only removes friction; it strengthens the moat around your slice of the ecommerce platform market.

6. Revenue model innovation

A. Subscription perks – Poshmark’s Posh Plus tier grants early access to drops and discounted shipping. Predictable recurring revenue insulates against seasonal swings inherent in any ecommerce market.

B. SaaS toolkits – ThredUp’s B2B dashboard lets retail partners track sell-through and CO₂ savings, reinforcing stickiness beyond pure GMV splits.

C. Vertical expansion – Some platforms now bundle repair services, verified cleaning, or premium packaging, raising take-rates while aligning with circular-economy principles.

Diversified monetization not only hedges risk; it positions you as a full-stack solution within the expanding ecommerce platform market.

7. Building trust at scale

Consumer skepticism around second-hand authenticity and condition remains a conversion killer. Future-proof leaders focus on:

- Transparent grading – Multi-point quality scores visible pre-checkout.

- Seller badging – Performance-based tiers that reassure buyers.

- Money-back guarantees – Platform-funded refunds that remove the “what if” barrier.

Blending technology with policy elevates the brand standard across the entire ecommerce platform landscape.

8. Sustainability metrics as growth levers

With ESG scrutiny rising, the ability to quantify carbon and landfill savings becomes a differentiator:

- Zara’s “Pre-Owned” program highlights emissions avoided per resale item, bolstering brand loyalty and drawing eco-conscious traffic.

Showing impact data at checkout not only attracts green-minded users; it arms marketing teams with share-worthy proof points—vital in a noisy ecommerce market.

9. Roadmap to maturity

- Data foundation – Centralize order, seller, and logistics data for AI tooling.

- Automation layer – Roll out listing auto-fill, dynamic pricing, and fraud AI.

- Experience layer – Add AR try-ons, community badges, and carbon tracking.

- Partnership layer – Offer resale-as-a-service for brands and retailers.

- Global optimization – Localize payments, languages, and duty calculators.

Following this staged approach helps platforms graduate from niche app to indispensable node in the broader ecommerce platform market.

Conclusion – Turning circular momentum into permanent advantage

The resale boom is no fad; it’s an economic and cultural shift baked into consumer expectations of value and sustainability. Operators that hard-wire AI tooling, supply-chain intelligence, and transparent trust mechanisms into their core offering will capture a disproportionate share of the $367-billion opportunity ahead. In a world where the ecommerce platform market gets more crowded by the quarter, the winners will be those who treat resale as a data-rich, service-oriented engine—one that scales profit, user delight, and planetary benefit in tandem. Partnering with Netscribes empowers resale platforms to scale intelligently through data-driven insights, AI-powered automation, and customer-centric strategy. Discover our end-to-end ecommerce solutions that deliver growth and efficiency.