Impact of COVID-19 on the Indian festive season

There’s an air of positivity around. With Dussehra behind, most retailers have a ballpark of where this quarter is headed amid these turbulent times. The festive season accounts for 35-40% of annual revenue for most consumer businesses. This year, consumer electronics and smartphone companies continue to top the charts with sales surging by 10-20%. Here’s a quick overview of the Navratri-Dussehra week in numbers before we dive in to analyze how COVID-19 is displaying distinct impact signals this festive season and what retailers can expect in the next couple of months.

Market outlook

There’s no doubt that India like other economies is heading towards a recession-like scenario. The first quarter of this year saw the GDP plummet by 23.9%, the worst ever since quarterly GDPs have been recorded. Job losses and pay cuts are imbuing customers to be more frugal in their spends, avoiding luxury splurges. Yet, among those with deep pockets automobiles, four-wheelers particularly, are one of the few big-ticket categories seeing growth, as personal mobility fuels demand amid rising infection rates.

For the majority, lack of job stability has shrunken spending confidence as disposable incomes take a hit. With most people hunkered down, unable to visit their loved ones as they traditionally did, connecting digitally via video calls and live chats are the new norm.

Given the convenience it affords, this behavior is expected to continue even post the pandemic. The same holds true for shopping online. People across age groups and geographies are growing increasingly digital and familiar with smart technologies to stay connected and shop. In fact, until now, Amazon saw 91% of its new customer base come in from small towns this festive season.

Spending patterns

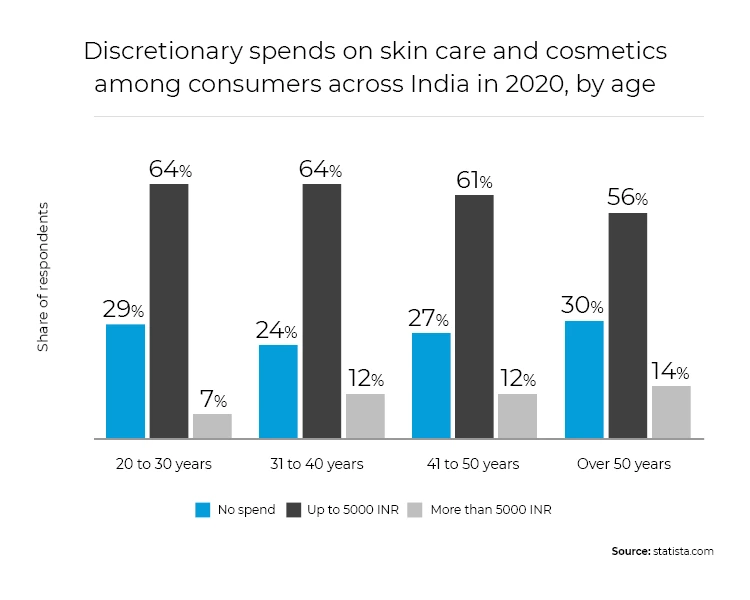

The attitude towards the present and near future has seen little change since the start of the pandemic. As the majority continue to work from home, people are spending more on essential needs. Next in line are discretionary expenses. But unlike the past years where travel and dining commanded a significant share of these expenses, this year people are taking a value-for-money, guilt-free approach to their festive splurges. Therefore categories like personal care and entertainment specifically in the OTT space are taking off. Other preferred segments for discretionary spends included furniture, electronics, fashion accessories, and apparel.

Adjusting to the new normal

Consumers feel a strong nexus with kiranas

Aspects like trust and traceability play no small role in these times. Plus, with kiranas, shoppers can conveniently skip the long queues and token-based waiting time, now the protocol in most supermarkets. FMCG brands and retailers would do well to bolster their network with these mom-and-pop stores to maximize their market share. E-commerce stalwarts like Amazon are already harping on this trend by offering local sellers programs like Locals Shops on Amazon.

Contactless payments reign in metros

According to a survey by EY 58% of the respondents are convinced that digital payments will be the new norm. However, 46% of respondents in metros still feel that cash will continue to stay as a mass medium of transaction. Yet 40% of kirana stores are eager to explore digital payments, given its increasing popularity.

DIY and specialty food products sweep shelves clean

With more time on their hands and savings from unfulfilled travel plans, this festive season is seeing spikes in DIY items like baking goods, instant foods, ready mixes, special masalas, and namkeens. 79% of kirana store respondents in non-metros and 75%in metros stated it’s becoming hard to source these items as customers are buying them in bulk.

What brands are doing to maximize market share

As the air around gets nippy, apprehensions about the pandemic intensifying are spurring consumers to be more cautious about their health and immunity-building routines. Studies show that India is leading the APAC market with the largest series of innovative foods, beverages, and supplements launched from March to July, supporting immune system enhancement claims. These timely innovators stand a good chance to capitalize on the current consumer mindset. For companies looking to follow suit and gain market momentum, here are the top innovations we’ve observed under the impact of COVID-19 on the Indian festive season:

- Expanding its immunity booster portfolio Amul launched Haldi Ice Cream, Amul Haldi Doodh, Amul Tulsi Doodh, Amul Ginger Doodh, and Amul Ashwagandha Doodh

- Diving in the immunity-boosting health products space, Mother Dairy, a brand that sells milk products, launched Haldi Milk (turmeric latte)

- Marico has extended its edible oil brand Saffola into ayurveda by launching immunity-boosting products – kadha and milk mix – to cash on the increased interest in natural ingredient-based products

Apart from these many other brands have repositioned their products to underscore their immunity building properties.

- Bottled water brand Bisleri has focused on how vital it is to be well hydrated and to boost immunity with its product’s “added minerals”

- Hindustan Unilever (HUL) highlighted the immunity-boosting qualities of vitamins C and D, plus Zinc, in an ad for Horlicks

- Dabur also introduced ‘Dabur Immunity Vans’ that aims to deliver its Ayurvedic medicines and immunity products directly to consumer households

So how can retailers and brands rise to the occasion under the impact of COVID-19 the festive season? Data-fueled personalization is the way to go. Monitoring how your customers are reacting to existing realities at a granular level, and the ability to transform these cues into strategic moves is what differentiates winners from the rest. To know how your business can gain this consistent competitive edge in your e-commerce endeavors contact us.