RPA in financial services: A catalyst in digital transformation

In today’s highly volatile market, the financial industry is under tremendous pressure to keep costs low while delivering enhanced value. Customers today expect quick and easy access to services, greater personalization and value for money. To meet these demands, financial institutions need to improve the quality and efficiency of their services, while managing costs. A rising number of financial companies are leveraging robotic process automation (RPA) meet these goals. By automating structured, rules-driven processes, financial companies can improve risk management, capacity utilization, accuracy, and more. Here’s a look at how various sectors in the financial realm are using RPA.

Banking

According to Netscribes research, RPA investment in the banking sector will exceed $800 million by 2020. From vendor assessments to risk management, from accounts payable to customer support, banks are experimenting with RPA across the enterprise to cut down processing time, minimize human intervention, and speed up decision-making.

RPA in Banking

Japanese bank, SMFG, in partnership with UiPath, plans to create nearly 3 million hours of capacity by 2020 through the use of RPA. Some of the key applications of RPA in SMFG include compliance and risk operations, information gathering, reporting, payments and application processes. JP Morgan Chase & Co.is automating loan filing tasks with its AI-powered COIN program, cutting down 360,000 hours of work down to seconds annually. With a major push on automation, the company spends 40% of its technology budget on new technologies including AI, RPA, and blockchain.

Insurance

Nearly 50% of employee time in the insurance industry is spent on collecting and processing data, often spread across disparate systems. Through RPA, labor-intensive work such as data extraction, verification, and report generation are being automated across functions like claims processing, underwriting, regulatory compliance, risk assessment, and fraud detection.

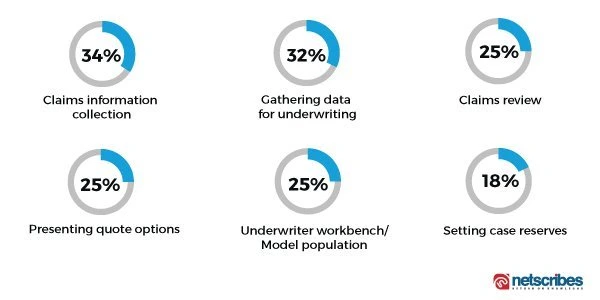

According to a PWC survey, a majority of insurers currently use or are planning to use RPA in the following operational areas:

Use of RPA in Insurance Operations

Prudential Financial’s RPA implementation to help process payment mismatches led to cost savings of up to $500,000 in just three months. Safe-Guard Products, an automobile insurance company, implemented RPA to automate their contract and claim-submission process, which helped in lowering the processing time from two hours to just fifteen minutes. According to Mckinsey, 25% of back-office operations will be automated by 2025.

[Get customized market and industry insights.]

Asset management

Characterized by a high level of customized manual activity, use of legacy processes and lack of technology integration, the asset management industry is ripe for disruption. According to a survey by CFA Institute, automation alone can reduce headcount in the asset management industry by up to 70%, and provide cost savings anywhere between 30% and 40%.

Robo-advisors

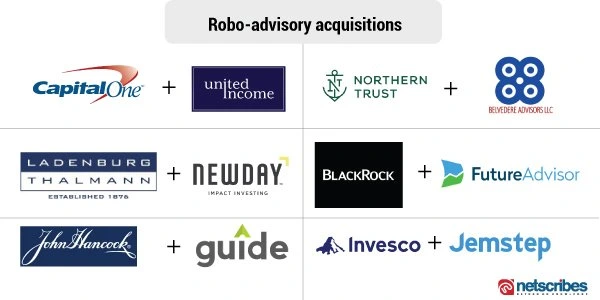

The growth of robo-advisors or automated advice platforms has been on the rise since the last few years. According to Netscribes research, the robo-advisory market is growing at a CAGR 53.8% and will be worth USD 74 billion by 2023. Robo-advisors can guide investment decisions using computer algorithms for setting asset allocations based on age and risk tolerance. By automating tasks such as tax-loss harvesting, rebalancing, data mining and performing predictive analytics, these software programs can help reduce inefficiencies and the time and cost of advice delivery. With the evolution of AI and machine learning, robo-advisory platforms are getting more advanced and are able to optimize client portfolios more accurately.

The growth of automated investment advice is evidenced by the numerous acquisitions of robo-advisory firms by large financial companies. Companies like J.P. Morgan, Schwab and Vanguard have developed their own robo-advice platforms.

Trade Finance

Trade finance operations involve a lot of paperwork, data audits, and compliance verification. Many financial institutions have automated these processes using RPA platforms, thereby improving productivity and lowering the time-to-market.

Here’s how RPA is simplifying trade finance processes:

Top RPA vendors

According to Gartner, the top five RPA vendors controlled 47% of the market in 2018. Here’s a look at the top 10 vendors by market share.

- UiPath

- Automation Anywhere

- Blue Prism

- NICE

- Pegasystems

- Kofax

- NTT-AT

- EdgeVerve Systems

- OpenConnect

- HelpSystems

Read more: Intelligent robotic process automation (RPA) in banking: Are we prepared for the future?

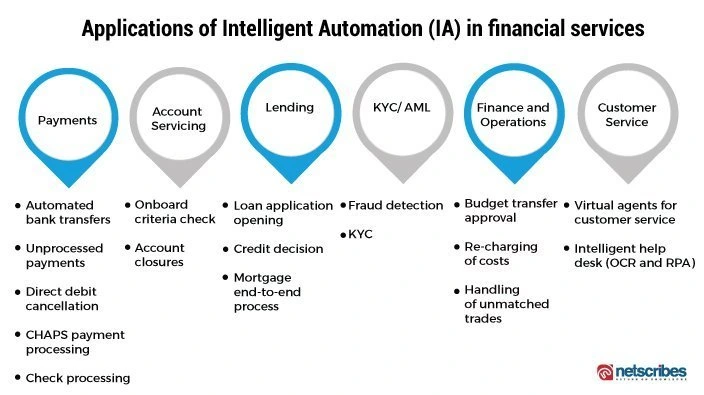

Transitioning to Intelligent Automation (IA)

It’s clear that RPA has found a niche in the financial industry. As financial institutions move past experimental stages and realize benefits from their RPA investments, they are extending its application across various functions within the enterprise. A number of companies are now exploring advanced AI-enabled RPA platforms or intelligent automation (IA) to make their automation more cognitive and cross-functional. By combining RPA with AI, machine learning, analytics, and virtual agents, financial services are now automating more than just back-office processes. Here’s a look.

Financial institutions across the globe are increasing their tech investments for a competitive edge. Netscribes conducts market and competitive research to help you see how competitors are leveraging advanced technology and adapting to the changing market environment. To request a consultation, please contact info@dev.netscribes.com.