The ripple effect of the coronavirus outbreak on the global economy

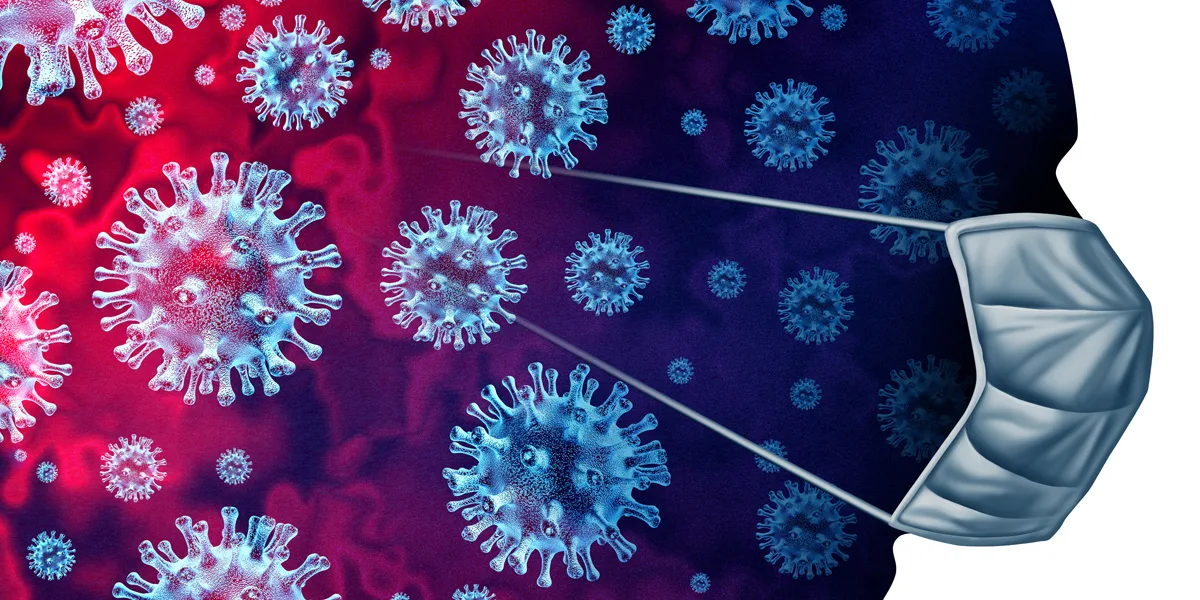

Ever since the SARS (Severe Acute Respiratory Syndrome) outbreak in 2003, China has never witnessed such a standstill until the occurrence of coronavirus outbreak. Believed to have emerged from a seafood market in Wuhan, China, the virus is rapidly spreading, accounting for about 40,000 cases across 30 odd countries as of February 10, 2020.

Being the largest producer of manufactured goods, global brands like Apple, Volkswagen, Burberry, and a dozen have come to depend on China’s profitable factories to meet increasing consumer demand. However, the panic triggered by this contagious respiratory disease has not only brought public places like restaurants, malls, and markets but also such factories and other commercial hubs to a grinding halt.

Moreover, the World Health Organization has declared the novel coronavirus (2019-nCoV) as a global emergency. Post this, The Economist Intelligence Unit announced plans of revising its baseline forecast for China’s real GDP growth in 2020 to 5.4%, from its existing 5.9%.

From luxury goods makers to automotive manufacturing units and beyond, here’s a dipstick into the setback brought about by coronavirus outbreak across various industries.

Tourism

According to the World Travel and Tourism Council, tourism is a huge sector contributing to 10.4% of the global gross domestic product (GDP) and 10% of global employment. With Chinese visitors facing a global ban, the tourism business has taken a hit. Dozens of airlines have trimmed the number of flights destined for China until the close of April 2020, thus leading to a steady decline in the tourism industry. This has taken a domino effect with serious implications across industries like food and beverage, entertainment, and luxury goods.

Luxury Goods

With travel options being limited, the influx of affluent travelers gracing the country’s tourist destinations has also been sapped. With traffic and sales slipping global luxury brands like Nike, Timberland, and Burberry have been compelled to shut down anywhere between 30-60% of its stores. Seasonal clothing categories are estimated to suffer more than other luxury product categories like watches and bags.

Apart from tourists, Chinese customers themselves account for about one-third of the sales incurred by such luxury brands. Yet, given the coronavirus outbreak, the parent company of Micheal Kors and Jimmy Choo announced it was reducing its quarterly sales forecast by USD 100 million.

Automotive

The automotive industry is also witnessing a slowdown as automakers shutting down their factories in Wuhan. Some of the leading players whose operations have reached a standstill include General Motors, Honda, and Dongfeng Motor among others. According to the automotive research firm IHS Markit, there would be a loss of a minimum of 3,50,000 units of vehicle production since the government has extended the factory’s shutdown till February 10, 2020, in some Chinese provinces.

The CEO of Bosch, an automotive parts manufacturer expressed his concern on the implications of coronavirus on its global supply chain as it is heavily reliant on China. Hyundai (South Korea) has postponed its car production owing to automobile parts supply issues from its manufacturing unit in China.

Food and Beverage

China accounts for 10% of Coca-Cola’s global sales volume. The outbreak has compelled the brand to bring operations to a complete stop resulting in a palpable short-term impact. Starbucks has also pulled the shutters on over half of its outlets in the country and is anticipating a material but fleeting hit.

With people scarcely venturing out of home, restaurants and hotels are also bound to witness plummeting sales. In fact, an article by The Economist mentions the owner of a restaurant chain voicing his apprehensiveness of people losing their jobs if the virus is not contained.

Oil

The decline in the price of oil creates disturbing economic imbalances and forces manufacturers to cut down the cost of production. Sinopec Corp (a Chinese oil and gas enterprise) plans to reduce its output in February 2020 by about 600,000 barrels per day (bpd), or 12%, which is the steepest cut in a decade.

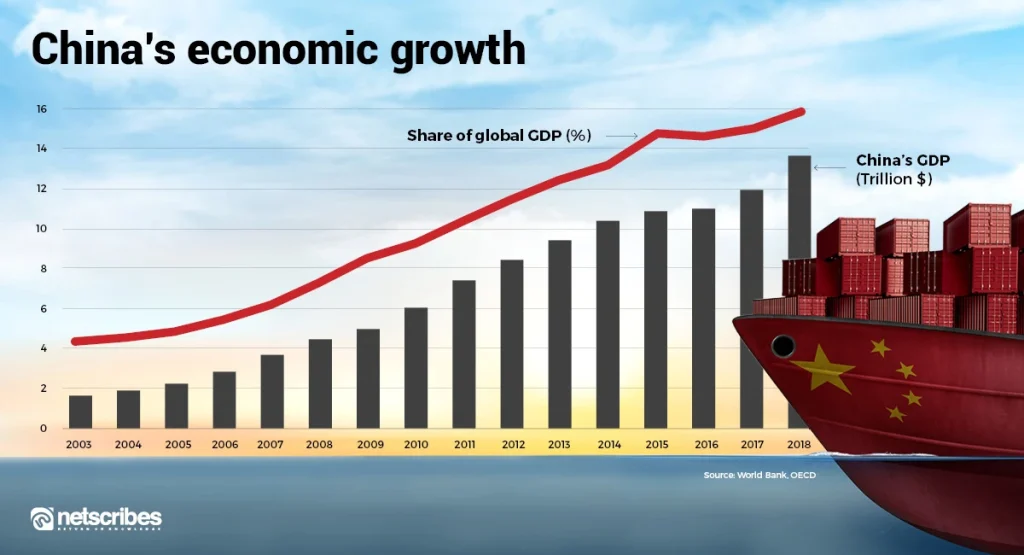

A decline in the demand for a product is an indication of a fall in business activities across China, winding down the pace of its economic growth. Moreover, with China being the second-largest economy in the world, its ripple effect is bound to be experienced across the globe.

Economists believe that it is too early to forecast the extent of the consequences. However, a halt could disrupt supply chains across industries. Goldman Sachs, an American bank, estimated that the Chinese economy would drive a hit to the annual growth of the world’s GDP by 0.1 to 0.2% in 2020.

It has also been anticipated that the breakout of the coronavirus is worse than the SARS epidemic. In 2003, China represented 4.2% of the global economy. However, now it accounts for 16.3% of the world’s GDP. The unpredictable nature of this outbreak is making it difficult to fathom the realities and scale of its global economic repercussions, yet it can be said that the global GDP will experience a tangible impact.

For a detailed evaluation of the implications of the coronavirus outbreak and what decisions makers within your organization must know before signing off on business moves, contact info@dev.netscribes.com.