The role of data in ecommerce: How to use insights to drive growth

Highlights:

- Unified data stack fuses behavior, transactions, and context for clarity.

- Capture-analyze-test-scale analytics loop fuels continuous growth wins.

- Walmart’s AI inventory forecasting sliced stock-outs by nearly 30 %.

- ASOS data-led personalization boosted click-throughs 35 % and cut returns 18 %.

- Warby Parker try-on metrics drove 75 % email follow-up conversions.

- Governance plus north-star KPIs turn raw insight into margin expansion.

In 2025, competition in online retail is no longer about who has the biggest catalogue or flashiest ads; the winners are the brands that turn data in ecommerce into clear, profitable action. Every click, search, return, and review leaves a digital breadcrumb. When those breadcrumbs are woven into a coherent story, they power sharper decisions, stronger customer relationships, and sustainable ecommerce growth. Yet many small and midsize companies still struggle to translate raw spreadsheets into real-world impact. This article offers a practical, 1,000-word roadmap for using data in ecommerce to accelerate results while keeping the tone value-driven, consultative, and easy to understand.

Why data matters more than ever

Customer journeys now hop between apps, devices, and physical touchpoints. Without a unified view, marketing budgets balloon, inventory piles up in the wrong warehouse, and margins erode. Strategic data in ecommerce analysis plugs those leaks by showing which channels attract high-value shoppers, which promotions cannibalize margin, and when to replenish stock. Companies that pair disciplined collection with ecommerce analytics consistently slash acquisition costs by 15-30% and raise average-order value (AOV) by double digits, even during inflationary headwinds.

The building blocks of insight

At the heart of any modern ecommerce intelligence system lies a robust data stack built on three foundational layers:

- Behavioral events – These capture user interactions across the journey, such as page views, product searches, clicks, and add-to-cart actions. They offer a real-time lens into intent and engagement.

- Transactional records – These detail the outcomes of interactions, including purchased SKUs, applied discounts, refund history, and shipping preferences. They form the financial and logistical core of customer behavior.

- Contextual signals – External variables like weather conditions, geolocation, device type, and marketing sources enrich the raw data, helping decode the “why” behind consumer actions.

But collecting data is only the beginning. Without disciplined governance, data quickly becomes fragmented or misleading. Strong foundations—standardized taxonomies, privacy-compliant policies, and unified customer identifiers—are critical to ensuring consistency and trustworthiness across systems. Once this structure is in place, machine learning models can go beyond surface-level reporting. They uncover deep patterns and correlations invisible to manual analysis, powering real-time recommendations, personalized merchandising, and price optimization strategies. The result: an adaptive commerce engine that responds instantly to demand signals and behavioral shifts, driving sustained ecommerce growth and customer satisfaction.

From numbers to narrative: The analytics loop

High-performing teams run a four-step loop—Capture → Analyze → Test → Scale. Analysts first use ecommerce analytics to form hypotheses (“Will free returns increase conversion in premium categories?”). Controlled A/B tests validate impact. Wins are rolled out broadly, and insights are shared in plain-language dashboards. This allows marketers, merchandisers, and executives to act on the same truth. Over time, this loop embeds data in ecommerce thinking across every department.

Case study 1: Walmart – Predictive inventory reduces stock-outs

Retail titan Walmart ingests more than 2.5 petabytes of operational information every hour. In 2024 it rolled out an AI-driven inventory ledger that forecasts local demand at SKU level. By repositioning stock days before peaks, Walmart cut out-of-stocks by up to 30% and trimmed holding costs. The same models now determine when to mark down seasonal items, unlocking multimillion-dollar margin lifts.

Lesson: Accurate data in ecommerce paired with machine learning turns back-end logistics into visible customer advantage, directly fueling ecommerce growth through higher availability and lower carrying costs.

Case study 2: ASOS – Personalization drives engagement

Fashion giant ASOS faced plateauing sales until it mined browsing history, style preferences, and social chatter with ecommerce analytics. Personalized product feeds and size guidance lifted click-through rates by 35% and reduced returns on fitted garments by 18%, contributing to a double-digit revenue rebound within a year.

Lesson: When shoppers feel seen, they spend more—and come back sooner. Granular data in ecommerce makes that possible at scale without ballooning ad budgets.

Case study 3: Warby Parker – Try-on metrics rocket conversion

Direct-to-consumer eyewear brand Warby Parker tracks how long customers linger on each frame in its virtual try-on app. Merchandisers then email the most-loved styles within hours, achieving a 75% follow-up conversion rate and holding returns under 10%.

Lesson: Micro-level behavioral metrics anchor rapid-fire experimentation. Even niche brands can wield data in ecommerce to outperform giants when insights trigger timely, relevant nudges.

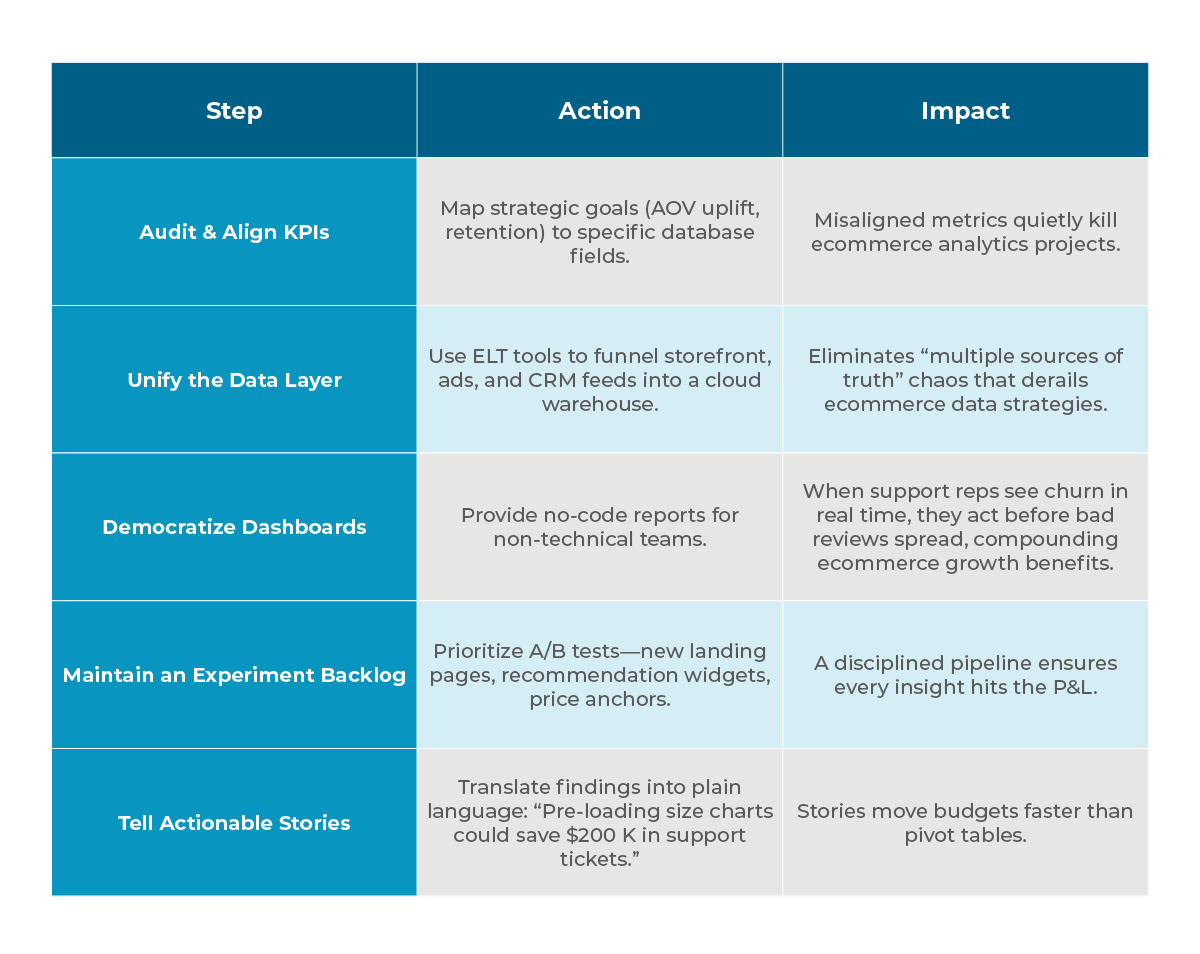

Best-practice framework for teams of any size

Avoiding common pitfalls

- Data fatigue: Tracking everything dilutes focus. Anchor decisions to three north-star metrics linked to ecommerce analytics impact.

- Siloed ownership: Marketing, ops, and finance must share one data dictionary.

- Privacy blind spots: Regulations like GDPR and India’s DPDP Act demand consent management and encryption be baked into your data in ecommerce architecture from day one.

Looking ahead: The AI multiplier

Generative AI is democratizing predictive modeling. Soon, category managers will chat with dashboards to forecast demand in seconds. Brands that invest today in disciplined data practices will convert this edge into tomorrow’s market share.

Conclusion

Whether you run a 20-SKU niche store or a marketplace behemoth, your future moat is insight, not inventory. Teams that treat data in ecommerce as a strategic asset—capturing, analyzing, and testing in a relentless loop—translate intuition into evidence and evidence into enduring advantage. By pairing disciplined ecommerce analytics with a culture of experimentation, you turn small wins into sustained momentum. Start with clean data, stay laser-focused on practical business questions, and let insight-driven action be the engine of your next wave of online success. Our data-engineering and ecommerce-analytics specialists translate every click into measurable growth, higher margins, and repeat loyalty.